I love a good personal finance thought piece. One of my go-to questions for friends lately is - give me your hot take (it’s elicited some great conversations from weight loss drugs to friendship boundaries). But talking to everyday people about their finances, it’s abundantly clear that actionable information on financial decision-making’s tactical ins and outs is still very much needed. It’s too common to hear people say they have no idea what they can or could spend, including for big purchases that will have an outsized impact on their finances for years to come. In response, this and the following few newsletters will be about those big purchases (car, house, education) and include some more tactical, practical information that hopefully will help you if you are making these decisions (or you can send it to a friend who is).

Transportation (aka a car in most parts of America) is one of the biggest expenses for households. On average, it accounts for 17% of annual spending (over $13k), with those in rural areas spending significantly more than those in urban areas. Most people need a car to get around and to get to work (~45% of Americans have no access to public transportation). The result is that 90% of households have a car, and nearly a quarter have three or more vehicles.

Making sound decisions about vehicle purchases will go much further than avoiding getting a coffee a few times a week. Here’s the framework that I like to use to think through these things and to make sure you are looking for transportation options within your budget, not making a budget for the option you want.

What’s the bigger picture?

How much are you currently paying for transportation? Maybe you don’t have a car payment, but you still pay upkeep, taxes, gas, etc. Knowing how much you spend is a good starting point and often eye-opening. Last year, we spent almost $2000 on keeping our cars running. We had no significant repairs, but oil changes, registration, insurance, and gas add up. This year, I’ve already spent that much on just tires!

How do your transportation costs fit within the bigger picture? Is the amount you spent sustainable? Does it feel like too much? A reasonable amount given your other obligations and desires? Something that you could easily add to? This requires knowing your bigger picture - how much you can spend and should save to meet your goals.

Calculate your debt-to-income ratio: One thing to be aware of here is your debt-to-income ratio (total monthly debt payments divided by total monthly income). If you are looking to apply for a car loan (or other loans such as a mortgage), lenders won’t approve you if you have too much debt compared to your income, or you will get less favorable loan terms. <36% is generally the threshold for auto loans. If yours is above that, you probably want to consider paying down some debts before applying for a loan.

What amount can you/do you want to pay for transportation? Personally, I don’t care too much what car I drive. I value functionality more than flashiness. But that’s just me. You might love something fancy and be willing to spend more on a vehicle with leather seats and all the new bells and whistles. If you are thinking of picking up more costs for your transportation, I like the exercise of trying that cost out before you lock it in. Put your new car payment (or the difference) aside each month in savings for a few months to see how it feels. After a few months, you will better understand how it fits within your everyday spending and maybe have a little more for your down payment.

How are you going to pay for the car? Do you have cash, or do you plan to finance? How about a trade-in? These are essential questions to ask so that you can direct your research!

How can you make the most of your money?

Once you’ve figured out your bigger picture and transportation budget, how do you make the most of it?

It’s worth asking if you even need a car or if there are other options available that you might want to consider. I have friends who live in large cities with abundant public transportation, who don’t have a car and rent cars the few times a year they need one. One even rents the covered parking that comes with their condo for a little extra money!

We have two cars currently, but if one calls it quits in the next year or so, we plan on sharing a car. We can walk to childcare, and grocery delivery is a thing. This town isn’t that big, and one of us couldn’t drop the other off at something if needed.

What car(s) meet your needs and wants? Do your research. Maybe you have your heart set on an exact car, but perhaps you’re just looking for something with 4-wheel drive. There are always new options, and it’s worth taking your time to look into them. If you are looking for a new car, you might consider prior model years if available - these often come with most of the same features at a lower price point.

How much does that car actually cost??! It’s easy to walk into a dealership and be swayed by the seemingly affordable monthly payments. But we know that a vehicle comes with more costs than the monthly payment or sticker price. This is called the ‘True Cost to Own.’ If I bought a new version of my current car, the total cash price would be $28,050, but the five-year estimated true cost to own is $34,113. It’s worth comparing these and calculating these numbers for yourself because they can vary widely for seemingly similar cars.

Compare buy/lease and new/used options. Typically, buying a used car is going to be the best value. But sometimes, surprisingly, leasing can be the better option, especially for electric vehicles. The leasing company can take advantage of tax breaks you may not be able to access as an individual, bringing the cost down. Buying new can save money if you are relying heavily on financing and have a lower credit score, given that used car loans can have much higher interest rates. Run the numbers for yourself.

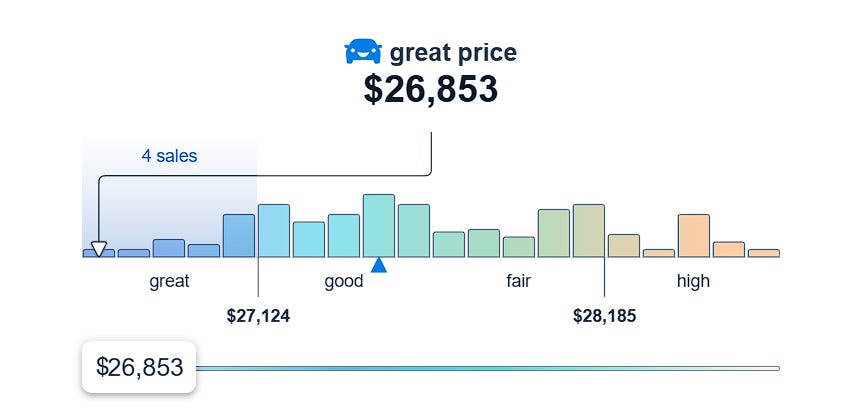

Know what a fair sticker price is. Websites like Edmunds have great data about the prices people pay for the same car. Use this to set your expectations as you go to buy and negotiate.

Get (multiple) insurance quotes for any cars you are considering. The price for different cars, given your individual profile, where you live, your credit score, etc., can vary greatly.

Take the time to get preapproved for a loan if you plan to buy (even if you don’t plan on using it). This lets you know what a fair rate is when you are at a dealership. You can even compare personal loans to auto loans. Your bank or credit union is likely the best place to start.

Ready to buy?

Where are you going to buy the car? These days, you can buy a car entirely online. You can walk into a dealership. You can find a used car on Craigslist or Facebook Marketplace. No matter where you choose, make sure you are getting a good deal.

New car tips

Check for any special rebates, discounts, or promotions before you go. Ask when you are there if they have any current ones or if any are coming up soon.

Check that you are eligible for any tax rebates and incentives offered.

Read the fine print of any manufacturer financing; some promotional interest rates do not last the full length of the loan.

Used cars tips

Get the CARFAX report.

Print bills of sale and make sure to get all paperwork (registration, title, inspections, taxes)

Confirm any warranty transfers.

Do a mechanical inspection before finalizing (especially if you are buying from a private party, not a well-respected dealership)

Choose a safe meeting location.

Test drive the car (worth doing it again even if you did it already - this is a big purchase)

Add insurance (preferably before you drive away!)

What is the purchase going to look like? On average, you’ll spend a few hours (think 2-3) at a dealership. Give yourself plenty of time, no matter how you buy, and don’t be afraid to walk away. Know your numbers (how much you can afford, what your interest rate should be, how much your trade-in is worth, etc.)

Final tips and tricks

You don’t need to tell a dealer or anyone you’re negotiating with how much you can afford, if you are paying with cash, or if you will do a trade-in. You can always use the line “if it’s a good deal.” You can always go all the way to the financing stage and ask to know the cash price. You can always finance the car and pay it off in full when you get the first bill! (Double check that there are no prepayment penalties.)

Write down the VIN of the car you test drove and are planning to purchase. You don’t want to drive away with a different car that hasn’t been inspected and may be missing features.

If you are financing your car, ensure your loan is FULLY approved before signing the paperwork. If it is still pending, wait before handing in a trade-in or driving off with your new vehicle. You don’t want the loan finalized with a higher interest rate or different, less favorable terms than expected.

Do you have any other tips and tricks to share? Special thanks to my friend Rebeccah Morse, AFC® for inspiring this post and sharing her valuable insights on car buying with other financial professionals.

Bonus: Should I lease or buy my next automobile?

Keep reading with a 7-day free trial

Subscribe to The Financial Planner to keep reading this post and get 7 days of free access to the full post archives.