A baseline financial plan illustrates the trajectory of your financial future by taking into account what you have now, what you are projected to make in the future and your current non-negotiables. It is a benchmark for comparing other actions and optimizations, a way to measure tradeoffs, and an information tool for decision-making.

If you want to read about the financial planning methods used and why, check out “A Note for the Nerds.”

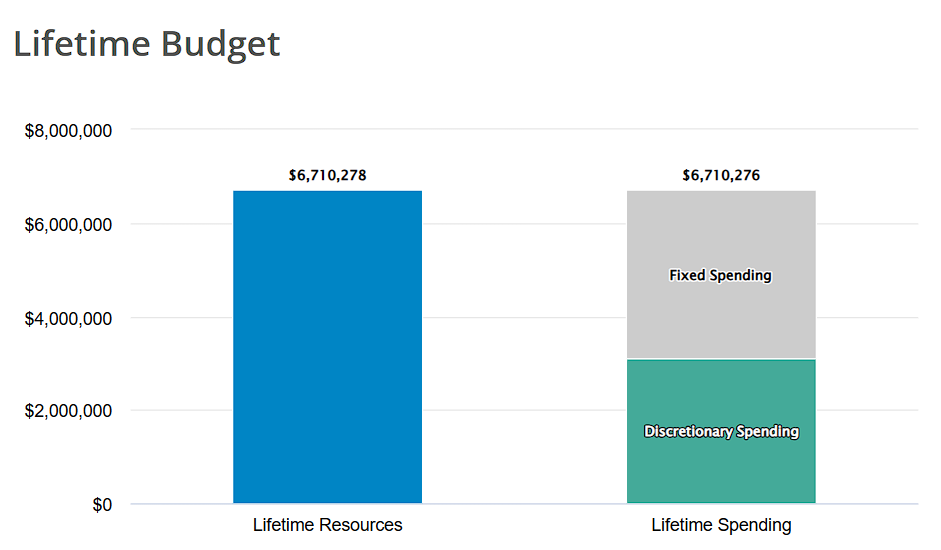

A good baseline financial plan puts this critical information in understandable, actionable, and relevant terms. This looks like an amount of lifetime resources, yearly spending, and saving recommendations.

The lifetime resources are exactly what they sound like. They are all the resources you have and are projected to have over the course of your lifetime. Mathematically, you can’t spend more than you will have.

The spending and savings recommendations are also exactly what they sound like. A dollar value that you can spend this year and an amount that should be saved/invested. They are created using a few assumptions:

You will meet your goals. If you say you will retire at 62, this is what it will take to do that.

You want to maintain your living standard. This means that you don’t want to have to spend drastically less when you retire or have a planned financial change.

You have cash flow constraints. You might have an inheritance of a million dollars coming in 10 years, but right now, you only have your paycheck. Unfortunately, you can’t spend the money you will receive in the future.

What does this look like?

Once you have your baseline, you can compare your lifetime resources and yearly spending based on different decisions. For example, what if you invest in a Roth IRA instead of a taxable brokerage account? What difference would that make today and over the course of your life? What would the impact be of buying instead of renting? How would retiring a few years earlier look? Any financial decision can be easily compared in its impact on your spending while still allowing you to reach your goals.

How to make a baseline financial plan

I want to be able to give an easy back-of-the-envelope way to make a baseline financial plan, but in good faith, I cannot say that it is going to be accurate. Even at baseline with a relatively simple set-up, there are a lot of factors at work!

To account for these variables (think taxes, social security, inflation, etc.) I use a piece of software called MaxiFi. Anyone can sign up for an account and walk through the steps to create a baseline financial plan (and all the comparison plans to optimize your lifetime resources and spending power).

If you want to walk through it with me, let’s schedule a time to talk.

If you want to get a taste of what a plan might look like for you, paid subscribers can fill out the form below and receive a baseline financial plan, including their lifetime resources and a spending and savings recommendation.