A few weeks ago, I asked my paid subscribers if they had a financial planning question they were curious about. Today, I am excited to share the first entry in The Financial Planner Q&A series! These days, you can ask Reddit or your AI assistant of choice your questions, but they’re not going to answer from a holistic financial planning perspective. They’re not going to ask you what you want your retirement to look like or even how much you have in your retirement accounts, AND THESE THINGS MATTER!1

Therefore, each month, I’ll answer one relevant reader question in the newsletter from a holistic financial planning perspective. I see it as a chance to learn and make financial planning more exciting, because what’s more exciting than the questions swirling around in the brains of real people trying to make real money decisions?

Personally, I had so much fun putting this together. I could have kept going with all the potential things to think about, just for this one question. One question begets so many more questions. Many answers depend on the answers to other questions. Unfortunately (or fortunatly, depending on how you look at it), it’s never quite as simple as just buying RIVN.

So, without further ado, let me introduce our first questioner and their question:

Tell us a little about yourself.

I am a married 58-year-old medical professional. I work full time, and my investing has been putting money into my job’s 403b plan. We recently bought a house, so we have a mortgage. Our cars are paid off, and we have no other debt except for the home.

What is your financial planning question?

I keep hearing to diversify your portfolio. I do not own any personal stock at this time. I do own some Ethereum, some silver, and some vintage baseball cards :) Should I be trying to diversify, such as buying personal stock (eyeing Rivian), or buy gold or Bitcoin, or property, or make any other moves? Or is it best to just continue to focus on the 403b plan until I retire?

Why is this question important to you?

I am beginning to look at these options as I ease slowly towards retiring.

First of all, kudos to you, medical professional, easing towards retirement. It seems like you have been mindful about your finances and have an idea about where you want to end up (retirement!). Putting money into a tax-advantaged retirement plan such as a 403b is a cornerstone of saving for retirement. Not having high-interest debt frees up your cash flow from your job, allowing you to save, invest, and live the life you want.

The question of ‘Should I be trying to diversify?’ depends on a few things. Namely, what your goals are, what the current status of your retirement savings are, and some preferences/timeline considerations.

1. What do you want your retirement to look like?

Do you want to go on fancy vacations? Volunteer in your community? Write a book? Fund a grandchild’s education? Do you plan to work part-time or do some consulting? Having a vision for what you (and your spouse) want in retirement is the first step to a successful retirement. If you don’t have a good idea of what you want your retirement to look like, take some time to reflect. What does your everyday life look like? What are the big milestones you are looking forward to?

These things matter on a personal level - you’ve worked hard your whole career, and making the most of your retirement means knowing what ‘the most’ is to you. They also help us determine how much money you need/want to spend in retirement and how much risk you can/want to take now.

2. Where are you now?

You’ve been diligently putting money into your 403b plan and likely have a good chunk of money in there. But that could mean a lot of things depending on your behavior over the course of your career (think taking advantage of employer match, what investments you chose inside your 403b, what those investment fees were, if you made any withdrawals, etc.).

Your additional investment needs for your years leading up to retirement will depend on your current financial picture:

How much do you currently have in your 403b plan?

What does your (and your spouse’s) Social Security look like? And when do you plan on claiming it?

What are you invested in inside your 403b? Depending on your investments, you might already be pretty diversified! Hospitals near us default retirement plans into Fidelity target date retirement funds, which contain a mixture of U.S. stocks, international stocks, and bonds with asset allocation depending on your age. That is a good example, though. 403b plans are notorious for having poor fund choices with high fees. This is something that, if you haven’t looked closely at before, you should look at now.

How much do you have invested in outside investments (such as your Ethereum, the equity in your home, and cash)?

Do you expect to receive an inheritance or other significant inflows of money?

How much are you spending now? In other words, how much does your day-to-day life cost?

Should I be trying to diversify?

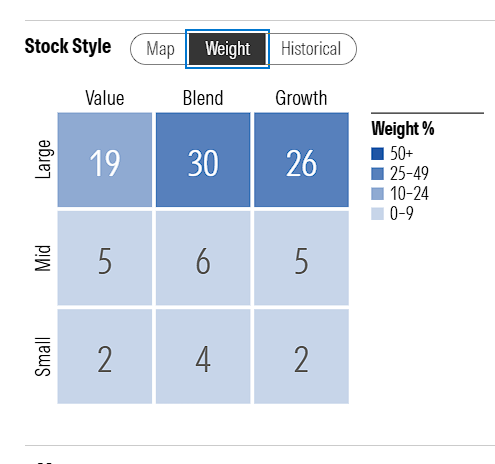

As you have heard, diversification is a key tenement in portfolio construction. The more uncorrelated investments you have in your portfolio, the less volatile it will be and the less risky it will be. Diversification comes in several flavors, one being the different asset classes: stocks, bonds, crypto, property, cash, etc. Even within the stock category, it’s recommended to have holdings across sectors (tech, consumer goods, etc.), company size (small, medium, and large), styles (value, growth), and geographies (U.S. and international). You want to make sure that if one company goes under (and we never know which ones those will be), your portfolio can still support your needs. If one sector suffers, your portfolio can still support your needs.

As mentioned above, you might already be diversified! Even if you aren’t, buying an individual stock, gold, or Bitcoin in significant amounts will likely make your portfolio riskier. If you take a look at your portfolio and it isn’t diversified, yes, diversify. The easiest way to do that DIY is to buy ETFs or index funds that hold a wide range of assets.

Based on the information you shared, another aspect of diversification to consider is tax diversity. Having all your assets in a 403b means you didn’t pay taxes on the money going in, but you will pay taxes on the money going out. At a certain age (age 73 for a currently 58-year-old), you will be required to take money out of your 403b and pay taxes on it - even if you aren’t going to spend it and would rather it keep growing. These required minimum distributions (RMDs) can create what is colloquially referred to as a tax bomb. It’s called a tax bomb because, depending on the size of your account and your spending needs, you will have a very large tax bill when you are required to pull out your money.

Having money in a Roth account and/or a brokerage account can help mitigate this. Consider a Roth account or even Roth conversions (depending on the value of your 403b, your current income, and the impact on your Medicare premiums) to combat this. Taxes are paid now and not later for Roth accounts, and there are no RMDs on Roth accounts. Taking money out of a brokerage account is taxed at the capital gains rate, not the income tax rate, giving you flexibility in retirement.

Retirement investing mindshift

A retirement investing mindset differs from an accumulation mindset. You likely have seen great gains in your portfolio over the past 15 years (most people have!). You have also received a paycheck, which has likely covered your spending needs.

In retirement, while your investments will likely still grow, the goal for people often shifts from growth to preservation. It’s more important that you don’t run out of money to pay your bills than if Bitcoin goes to the moon.

This means a couple of things,

having a couple of years’ worth of cash or near-cash equivalents when you retire. If the market is down when you retire, you don’t want to sell from your portfolio. This will permanently reduce its value and negatively impact your living standard for years to come.

considering the tradeoffs of taking Social Security later. There’s a ~76% increase in your monthly benefit if you claim at 70 compared to 62, but you would likely have to pull more from your portfolio earlier to live off of. The benefit of waiting is especially pronounced for those with above-average life expectancy.

potentially putting more money toward your mortgage. Many people want to pay off their house before retirement so that they have lower expenses. Some studies have found that retirees are happier when their home is paid off. Depending on the interest rate on your mortgage, you may be getting a good return with this option.

Is it time to bring in a financial professional?

If this sounds like a lot, it’s because it is. Retirement these days can be complicated. Preparing for retirement is one of the most common times people bring in a financial professional. Many choices you make now can have an impact on your spending ability for years in the future. Medical professional, easing towards retirement - I’m happy to help you find a financial planner that would fit your needs if you are interested. You know where to find me!

Do you have a financial planning question you’ve been curious about?

If you’re wondering about it, chances are others are too.

Submit your questions to The Financial Planner Q&A series below! Each month, I’ll answer one relevant reader question in the newsletter. If yours is chosen, you’ll get your question answered from a holistic financial planning perspective, and everyone else will get a chance to learn alongside you. If I don’t know the answer, I’ll tap a trusted financial professional who does.

I look forward to fielding your questions!

Keep reading with a 7-day free trial

Subscribe to The Financial Planner to keep reading this post and get 7 days of free access to the full post archives.