This is part of a series about common personal finance misconceptions I’ve heard from friends, relatives, and book club acquaintances. I don’t want to be the person who stops the conversation to tell them, “It doesn’t work like that!” (I’ve tried, and some have not taken it well). But at the same time, I don’t want them making important financial decisions from a place of confusion and sometimes fear. Hopefully, this can help solve both problems.

My credit score is 650, but it doesn’t really matter.

To that, I’d like to ask, which credit score? And matter for what?

A credit score is a numeric representation of the risk to a lender of someone being unable to pay their bills on time. There are 88 different credit scores, all calculated through proprietary models. That credit score you see on Credit Karma or your Wells Fargo app is likely different from the credit score a lender will use to help determine their risk and your rate.

Does that matter? And does the number itself really matter? In short - yes.

While a credit score is not a judgment of your character or a moral badge of honor, it does affect your finances if you are taking out a loan, buying insurance, renting an apartment, and potentially in your job application process. A higher credit score will open doors and save you money. You cannot apply to certain types of mortgages without a minimum score (if you don’t have one, they will run an alternative type). Many premium travel cards won’t approve users without at least a 700. Security clearance can be denied to people with poor credit scores.

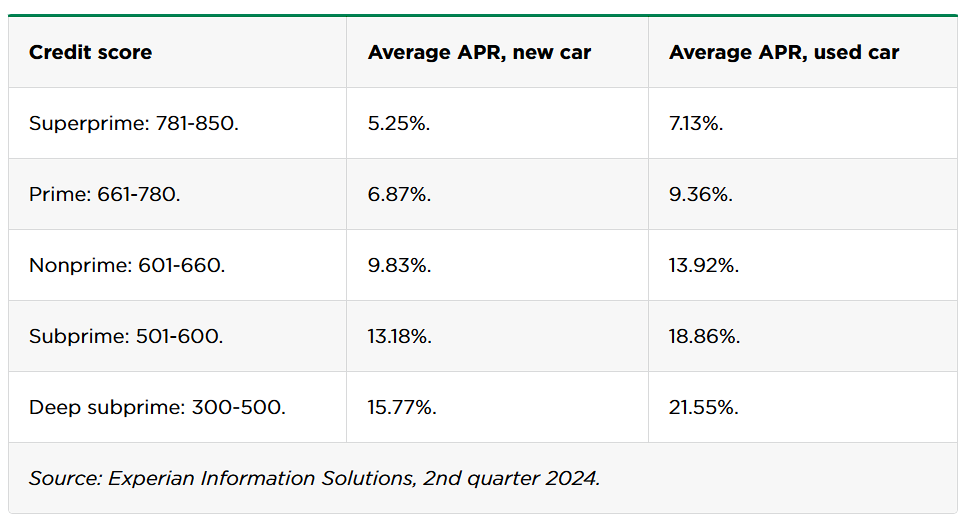

Let’s say you needed a new car. A higher credit score means a lower interest rate, more purchasing power, and a lower cost. Take a $25,000 car (MSRP on a new Honda Civic). If you had a hefty $5,000 down payment and a 48-month loan, your monthly payment would be $478 with a Prime credit score and $506 with a Nonprime score. Over the course of the loan that’s a $1,339 difference. If you pushed out the loan over 60 months, that would be an even bigger difference ($1,681), and the car would cost you even more!

Extrapolate that to any time you want to borrow money, from mortgages to private student loans. Add in differences in car insurance rates and the ability to qualify for some jobs. A low credit score can start to take its toll financially.

Knowing what score a lender uses arms you with understanding. It puts you in a better position to see if they are offering you a good deal or if now is the best time to make the deal. Even single-point differences can raise your rates and result in higher payments.

When I looked at all my scores (I got a free trial of a paid account for research purposes), there was a 34-point spread just in those that were scored out of 850. I also learned that some are scored out of 900 now!

What does that score mean, though, and how is it determined?

The classic FICO® Scores range from 300 to 850. Some versions are now scored out of 900. Vantage Scores are now scored on the same range but have different models in the past. In all of them, higher is better.

The rough breakdown of factors that impact your score is similar for all credit scores:

Payment History (35%) looks at if you pay your bills on time. The later you pay, the worse a ding on your credit is. By putting your bills on autopay or setting reminders in your calendar, you can help make sure you always pay on time.

Amounts Owed (30%) considers how much of your credit you use (a percentage of your credit limit) and your balances. Even if you are paying off your credit cards each month, your scores can decrease if you use a large portion of your credit limit. One thing you can do is set up alerts to pay your card if the balance gets close to 5% of your credit limit (a conservative threshold).

Length of Credit History (15%) evaluates how long you've used credit. What is your oldest account? What is the average age of your accounts? The rule of thumb here is not to close your oldest account, which is usually a credit card.

Credit Mix (10%) measures your different types of credit, such as credit cards, installment loans, and mortgages. One type of account that is almost always negative is a finance company. These are non-bank and credit-union accounts. Think of financing for furniture and the like. Closing these accounts can often improve your score.

New Credit (10%) adds up your credit inquiries and new accounts. These temporarily lower your scores, so it’s considered best not to apply for other new credit before considering and applying for loans on a major purchase such as a house.

These are your bread and butter. Even better is knowing what specific factors you could improve on.

A couple of months ago, I applied for a new credit card. In the packet they sent me (with my new card) was a report on my credit. Along with the number, it said,

Your credit report shows a lack of recent installment loan information.

Your credit report shows the length of time accounts have been established [is low].

Your credit report shows too many accounts with balances.

The length of time revolving accounts have been established on your credit report [is low].

If I wanted or needed to raise my score, especially my bankcard score (which this was), I’d focus on those first.

If you are trying to make a large purchase or are concerned about your credit score, start by pulling your credit report from annualcreditreport.com. Check it thoroughly for accuracy. If there are inaccuracies, start there. If everything looks good, I’d recommend getting a full lender credit report. These reports give you the credit score from all three credit reporting agencies and descriptions of what exactly is detracting from your score. You can get these from a non-profit credit counselor like My Credit Plan.

There is an entire subreddit about increasing your credit score. There are tips and tricks up the wazoo on social media. Unfortunately, it takes time to build from zero, and it takes time to improve from negative. It’s really about consistency and responsibility. Not sexy, but true.

At the end of the day, your credit score is only one part of loan decisions. Your complete profile, including your income, savings, and the type of loan, will also determine your eligibility and rate.

Is there something you are confused about regarding personal finance? Maybe others are, too! I would love to hear any ideas for topics to cover in future installments of this series.

Credit card basics

TLDR; Have a credit card but use it like a debit card. Only buy what you have the funds for and pay it off in full every month.

Well done, Taylor. Readers can learn much fe this post.