Credit card basics

TLDR; Have a credit card but use it like a debit card. Only buy what you have the funds for and pay it off in full every month.

I want to write about all the money we have saved and experiences we’ve been able to have thanks to a handful of credit cards, but I think it would be a disservice not to cover some basics first.

While it’s unfortunately too true that credit card debt is common (35% of people had credit card debt as of this January 2023 survey), with the average debt being over $5500 in the US, it doesn’t have to be the story.

Credit cards are a tool. They are tools that make a lot of money for the banks that issue them but can also be a tool for you to prove to the banks (and anyone else that can access your credit report) that you are responsible with money. They are the most accessible and easiest way to build credit. And whether you like it or not, credit is essential for your financial life.

I recently learned that more people/institutions could look at your credit report than I realized. I knew someone giving you a loan or renting a property could check your credit report - that makes logical sense. I didn’t know that some employers will check your credit, your car insurance agency might check your credit, and the utility company might check your credit. With all these places, a good report will get you better results - better rates, flexibility, etc.

So how do you get or keep good credit?

If you’ve never had a credit card before, get one. Do your research on what credit card would be best for you. My first credit card was free, and I got approved. I didn’t understand all the ins and outs, but thankfully I did know to pay it off. Hopefully, if you are reading this and don’t have a credit card, you will know to pay it off and have about ten legs up on 18-year-old me after reading this. NerdWallet’s rendition about getting your first credit card is an excellent place to start.

If you have a credit card,

Do:

Understand the fees, credit limits, due dates, and interest rates. Even if you understood it when you got the card, a lot of times, they change. Some cards are free for the first year and then start charging a yearly fee.

Use your credit card like a debit card. That is, only make purchases you can afford to pay off in full AT THE TIME OF PURCHASE. In other words, they are in your budget.

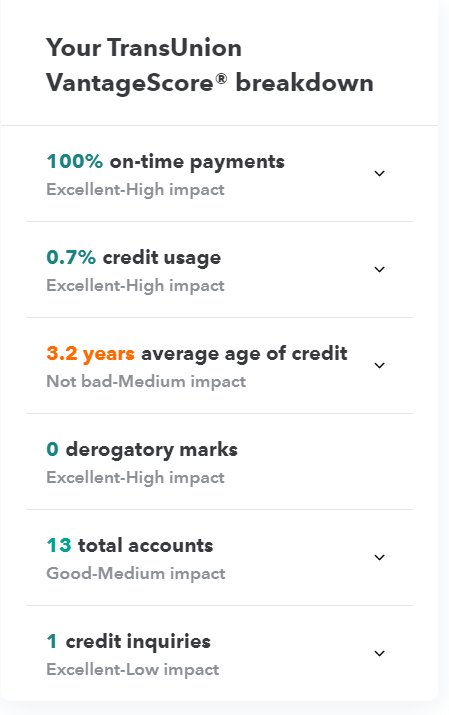

Pay off your balance in full. The most significant determiners of your credit are your payment history and the amount you owe. Paying on time, in full, is the best way to improve your credit report. This track record shows lenders, landlords, and your insurance agency that you can and will pay what you owe them. You are of less risk to them, and in turn, they will often charge you less.

Keep your credit utilization low (< 30%). Most credit cards have a defined credit limit. This is the maximum you can spend on a card before paying at least some of it off. Most of my credit cards have ridiculously high credit limits. My credit utilization is 0.7%. If you have a lower credit limit, just start by putting a few expenses on your card or pay them off more frequently than they are due.

Check your statements or tack your purchases using something like Mint. Do this before paying off the cards to catch any fraudulent charges or mischarges (beware of the Arco in South Sac that has gas pumps that charge you without pumping any gas).

Use customer service. Of course, contact customer service about any incorrect charges, but also contact them if you missed a payment and got charged a fee. Often they will waive it if it was an honest mistake and you routinely pay your bills on time.

Check your credit report. You can get a free report once a year from https://www.annualcreditreport.com/index.action. At the time of this writing, they are offering free weekly reports. You want to check that the information on the report is correct, and if not, dispute it, as it could damage your credit. We found out my husband was still an authorized user on someone else’s card who forgot to pay their bill by checking his credit report.

Don’t:

Close your oldest credit card. Part of your credit score is based on your length of credit history. The longer, the better.

Apply for too many cards (especially at once or before applying for a loan like a mortgage). Every time you apply for a card or a loan, that inquiry goes on your report. Too many inquiries results in worse credit. (I will caveat this with the fact that an inquiry generally will lower your credit only temporarily. Also, ‘too many’ is relative and open to a fair amount of interpretation, so take it with a grain of salt.)

What if I can’t pay my credit card off in full?

Stop, take a breath, and make a plan. What that plan could/should entail is a story for another day. Here’s an article to get you started: https://www.bankrate.com/finance/credit-cards/how-to-get-rid-of-credit-card-debt/#steps

In conclusion, credit cards are an essential tool in the toolkit. Having good credit will open doors and save money. Poor credit will do the opposite. Know thyself and set yourself up for success. The most surefire way to keep your credit spending in check - USE A BUDGET. Yes, the budget makes a comeback because I would spend all my money buying expensive cheese and never know I’d paid double for internet if I didn’t track it, and I bet you would too.

Disclaimer: My content is EDUCATIONAL, NOT prescriptive. I am not a licensed or certified financial professional (yet), so do your own research.