As I play with numbers on financial plans, it all seems so certain. You just put some money in these accounts, maybe take out this insurance, and you’re set!

The problem is, it’s never certain. And for so many of us, there are so many factors of uncertainty. The stock market. The future of social security. Inflation. Wages.

I know what we made last year and what we expect to make this year, but what about the year after that? Income can be a toss-up for anyone finishing training, returning to work, or changing jobs. What if you lose your job? What if you start a business? How about multiple of these?

My husband and I send each other job postings (and accompanying dream homes on Zillow) whenever we find something interesting. Many don’t advertise a salary, and salaries and the cost of living for similar jobs vary by more than 100%. It’s all so squishy.

Yet, we still make decisions based on the information we have. We make choices about how much to spend, save, and invest. A lot of that is based on our human capital.

What is human capital?

Human capital is a term that is straight out of an economics textbook.

Qualitatively, human capital is made up of your education, skills, and network. It’s your ability to do (and get) work that others will pay for.

“The skill set, knowledge and other intangible assets of individuals that can be used to create economic value for the individuals, their employers, or their community.“ -Personal Finance, Garmen & Fox)

Quantitatively, it’s the sum of your future labor earnings, a number that represents the conversion of your valuable human labor into capital that can be measured and stored.

“Human Capital is the intangible asset that enables individuals to generate labor income. It is the total of all future salary prospects.“ -Economics-Based Personal Finance, Puelz & Stevens

Why is it important?

For most, human capital is your largest asset. This is especially true the younger you are. Not factoring in your largest asset into your financial planning decisions leads to gross miscalculation of everything from current spending decisions to asset allocation (think not investing too much in the stock of the company that employs you).

“[H]uman capital interacts with financial capital. Understanding this interaction helps us to create, manage, protect, bequest, and especially, appropriately consume our financial resources over our lifetimes.” - Ibbotson et. al 2007

Take our family of four with two highly educated thirty-year-olds at the helm. While we are relatively light on financial assets, our human capital is pretty vast and relatively low-risk. As a result, we are spending a little out of savings this year and investing only up to the company match since we know our income will drastically increase in the next two years (thanks to my husband’s residency ending). What we do have invested, we can be more aggressive with since it’s such a small portion of our overall economic net worth (financial net worth + human capital). I need to buy more life insurance to protect our human capital…

Want to model your current human capital?

Like most things in financial planning, tabulating your future earnings has some inherent risk. You don’t want to count on your chickens laying golden eggs before they even hatch. Making assumptions about too much wage growth or the length of your career (many retirements are involuntary due to health or caregiving duties) can be overly optimistic.

Therefore, estimate conservatively. How stable is your current labor income? If you lost your job, what would be the low end of what you would get for a different job? How many years will you be working/want to be working? Will you take a year off to travel? Be home with a baby? When do you want to retire, or do you think you might have to retire?

Back of the envelope method

You can get a close approximation by multiplying the time you work by the amount you will earn during that time.

Human Capital = number of working years x expected yearly labor income

For example, 30 years x $50,000/year = $1.5 million in human capital (today’s dollars before inflation)

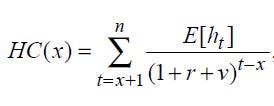

If you want to get fancy…

but don’t want to solve a scary-looking equation,

use a calculator. This calculator adds in inflation and wage growth as well as investment return. It gives you “the total amount you would need invested today, to equal the total earnings of a person's lifetime.”

Add your human capital to your balance sheet.